Importance of Due Diligence in M&A

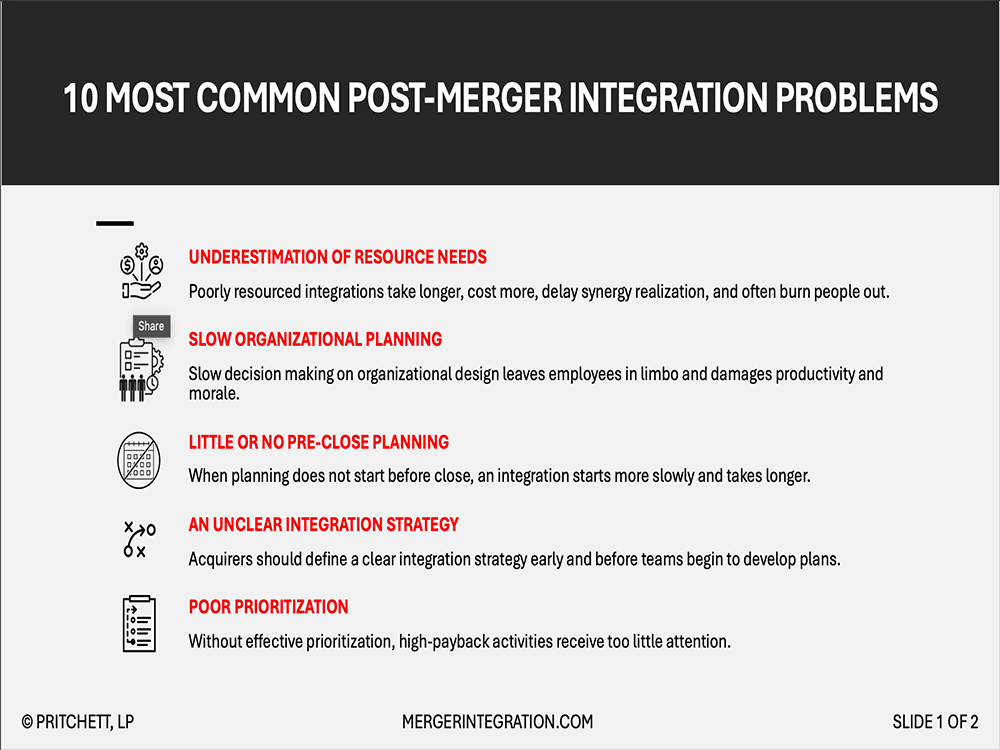

Due diligence is a critical process in mergers and acquisitions that involves a thorough investigation of the target company to uncover potential risks and opportunities, while M&A integration is the process of combining the two entities post-transaction. Effective due diligence sets the stage for successful integration by informing the integration strategy, identifying potential synergies, and highlighting areas that require attention, such as cultural differences, operational inefficiencies, or financial discrepancies. A well-executed integration plan, informed by comprehensive due diligence, helps ensure a smooth transition, minimizes disruptions, and maximizes the value of the combined organization.